In the ever-evolving world of financial markets, the allure of trading can be both thrilling and daunting. For many aspiring traders, the fear of losing hard-earned money often overshadows the excitement of potential profits.

However, what if you could dive into the markets depths without the peril of financial loss? That’s where practicing trading in a risk-free environment comes into play. This invaluable approach allows you to gain hands-on experience, develop strategies, and sharpen your instincts, all while navigating the complexities of market dynamics.

In this article, we will explore effective tips and tools that can help you hone your trading skills without the anxiety of actual monetary stakes, paving the way for confidence and skill as you prepare to enter the real trading arena.

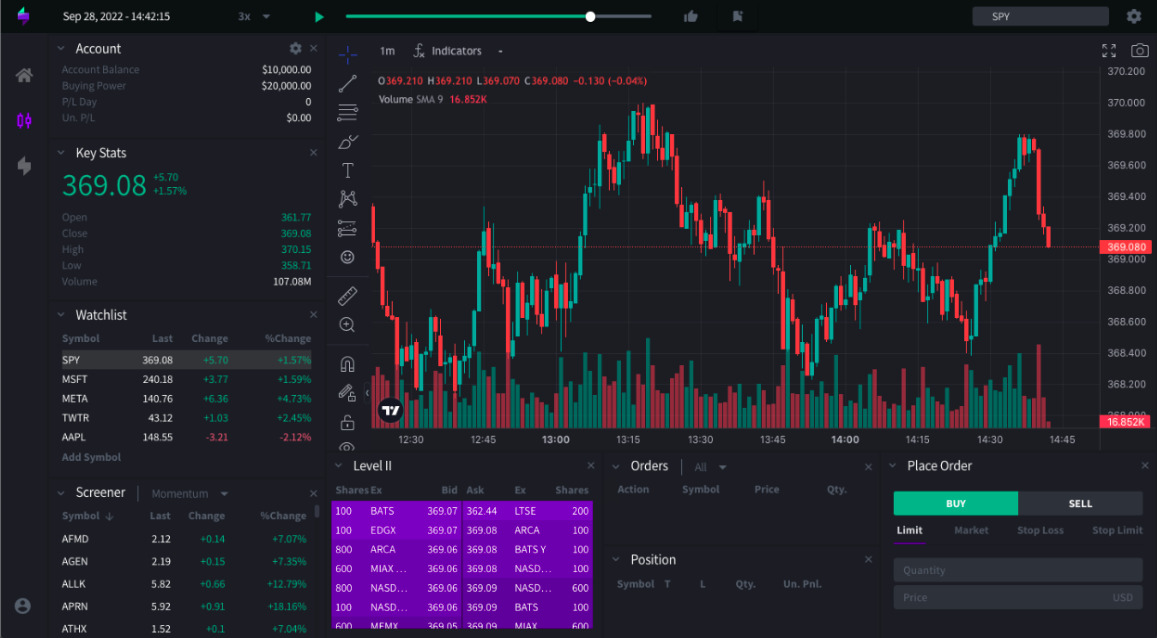

Understanding Simulation Platforms

Understanding simulation platforms is essential for those eager to hone their trading skills without the looming fear of financial loss. These sophisticated tools replicate real market conditions, offering users a playground to test strategies, analyze market behavior, and build confidence.

Imagine diving into a world where you can execute trades in real time, monitor market reactions, and fine-tune your approaches—all with virtual currency. Incorporating a free market replay tool can enhance this experience by allowing traders to revisit and analyze past market scenarios, providing deeper insights into market trends and strategies. Some platforms boast advanced charting capabilities and technical indicators, allowing for deep analytical exploration.

Others foster a vibrant community, where traders exchange insights and strategies. With options ranging from simplistic interfaces for beginners to complex systems tailored for seasoned traders, there’s a simulation platform to meet every individual’s needs.

Ultimately, leveraging these resources not only prepares you for the realities of trading but also cultivates a disciplined mindset that can lead to success in the unpredictable realm of financial markets.

Setting Clear Goals and Objectives

Setting clear goals and objectives is the cornerstone of successful trading practice, particularly in a risk-free environment. Start by identifying what you aim to achieve: Are you looking to refine your technical analysis skills, test new strategies, or simply build confidence? Break down these overarching goals into smaller, actionable objectives. For instance, you might decide to focus on mastering a specific trading platform or to consistently evaluate your decisions against predetermined metrics.

This targeted approach not only sharpens your focus but also transforms your learning into measurable progress. As you set these benchmarks, remember to account for potential hurdles and adjust your goals as you gain new insights.

After all, the journey of a trader is as much about adaptability as it is about ambition. By articulating a clear roadmap, you pave the way for meaningful growth and enhanced trading proficiency, all within a safe confines of simulation.

Developing a Trading Strategy

Developing a trading strategy is akin to crafting a finely-tuned instrument. It requires both an analytical mindset and a touch of creativity.

Start by defining your goals—what do you hope to achieve? Whether its consistent income or long-term growth, your objectives will shape your approach. Next, delve into market analysis—familiarize yourself with technical indicators and chart patterns that resonate with your trading style. Experiment with different time frames; the juxtaposition of day trading and swing trading can reveal fascinating insights.

Dont shy away from backtesting your strategies on historical data; this process not only enhances your confidence but also highlights potential pitfalls. As you refine your plan, remember to stay adaptable—financial markets are ever-evolving, and flexibility can be your greatest ally.

Embrace the journey of trial and error, and allow your strategy to develop naturally over time, leading you towards informed decision-making in the dynamic world of trading.

Conclusion

In conclusion, practicing trading in a risk-free environment is an invaluable strategy for both novice and experienced traders alike. By taking advantage of simulation platforms and tools, such as the free market replay tool, you can sharpen your skills, hone your strategies, and build confidence without the fear of financial loss. Emphasizing the importance of discipline, analysis, and continuous learning will ultimately empower you to make more informed decisions in the real market.

Remember, the journey to trading proficiency is a marathon, not a sprint—so take the time to practice and refine your approach until you feel fully prepared to navigate the exciting world of trading.